Grievance Redressal Policy

1. INTRODUCTION

The Board of directors of AGARWAL ASSIGNMENTS PRIVATE LIMITED (“the Company”) has designed and implemented he appropriate grievance redressal mechanism within the organization which ensures that all disputes arising out of the decisions of lending institutions' functionaries are heard and disposed of at least at the next higher level.

The grievance redressal policy is designed to address the issues, concerns, complaints, or grievances (“Grievances” or “Complaints”) of the borrowers (“Customers”) on the Agarwal Assignments website (www.agarwalassignments.com) and all associated mobile applications, if any (“Platform”). Agarwal Assignments has established a structured grievance redressal framework to ensure that the redressal of grievances is fair, just, and within the given framework of rules and regulations.

The Board of directors shall also provide for periodical review of the compliance of the Fair Practices Code and the functioning of the grievance’s redressal mechanism at various levels of management and a consolidated report of such reviews will be submitted to the Board at regular intervals, as may be prescribed by it.

2. GRIEVANCE REDRESSAL OFFICER:

The Board of Directors of the Company have appointed a Grievance Redressal Officer (GRO), who shall be responsible for overall functioning of the Grievance Redressal Mechanism of the Company. The Grievance Redressal Officer shall also be responsible to address grievances escalated to him / her and for ensuring prompt and efficient functioning of grievances redressal mechanism.

3. GRIEVANCE REDRESSAL MECHANISM

Any Customer having a grievance/complaint/feedback with respect to the product and service offered by Agarwal Assignments may write to the Company’s Customer Service Department in the following manner:

Filing a Complaint through following channels:

b. Letters- Customers can write to Customer Service, Agarwal Assignments Private Limited Unit No- G32, 6 at Ground Floor Devika Tower Nehru Place New Delhi-110019

c. Customer Care Number- The Customers can directly approach to Customer Grievance Cell, where the Company has dedicated Toll Free Number 9266305045 and a dedicated team that complies, addresss, and escalates customer’s calls every day. Customer Care Number: 73039 61350 (Between 10:00 am and 6:00 pm, from Monday to Saturday, except business holidays)Anonymous complaints will not be addressed.

3.2 Resolution Process:

b. The Customer Service Officer shall ensure that all complaints are resolved in a timely and effective manners, and status of resolution / closure of complaints in records is updated.

c. The Customer Service Officer shall monitor the complaints status to ensure that the complaints are resolved within 3 working days of receipt of complaint.

d. If in any case, the CGRM team needs additional time, the CGRM team will inform the customer the reasons of delay in resolution within the timelines specified above and provide expected time lines for resolution of the complaint.

e. Complaints registered through the above means are addressed within 5 (five) business days.

f. Grievances should be sent through the email registered with AGARWAL ASSIGNMENTS.

*Monday to Saturday from 10:00 AM to 6:00 PM

Level 2 Escalation: If a complaint or grievance submitted to Customer Service is not acknowledged or resolved within 15 days, or if the customer is not satisfied with the response received, they may escalate the issue to the Grievance Redressal Officer / Principal Nodal Officer.

5. ROLE AND RESPONSIBILITIES OF INTERNAL OMBUDSMAN:

ii. The following types of complaints shall be outside the purview of these Directions and shall not be handled by the Internal Ombudsman:

a. Complaints related to corporate fraud, misappropriation etc., except those resulting from deficiency in service, if any, on the part of the regulated entity.

b. References in the nature of suggestions and commercial decisions of regulated entity. However, service deficiencies in cases falling under ‘commercial decisions’ will be valid complaints for the Internal Ombudsman.

c. Complaints / references relating to internal administration, human resources, or pay and emoluments of staff in the regulated entity.

d. Complaints which have been decided by or are already pending in other fora such as the Consumer Disputes Redressal Commission, courts, etc.

e. Disputes for which remedy has been provided under Section 18 of the Credit Information Companies (Regulation) Act, 2005.

The regulated entity shall forward all rejected / partially rejected complaints under the categories (a) and (b) above to the Internal Ombudsman/s. The Internal Ombudsman shall look for inherent deficiency in service in such cases and take a view whether any of these complaints can be exempted under (a) and / or (b) above as decided by the regulated entity.

iii. Complaints that are outside the purview of these Directions should be immediately referred to the regulated entity by the Internal Ombudsman.

iv. The Internal Ombudsman shall analyze the pattern of complaints such as product / category wise, consumer group wise, geographical location wise, etc., and suggest means for taking actions to address the root cause of complaints of similar / repeat nature and those that require policy level changes in the regulated entity.

v. The Internal Ombudsman shall examine the complaints based on records available with the regulated entity, including any documents submitted by the complainant and comments or clarifications furnished by the regulated entity to the specific queries of the Internal Ombudsman. The Internal Ombudsman may seek additional information and documents from the complainant, through the regulated entity.

vi. The Internal Ombudsman shall, on a quarterly basis, analyse the pattern of all complaints received against the regulated entity, such as entity-wise (for CICs), product-wise, category-wise, consumer group-wise, geographical location-wise, etc., and may provide inputs to the regulated entity for policy intervention, if so warranted.

vii. Any other roles & responsibilities as specified in terms of the Master Direction.

6. AMENDMENT AND REVIEW OF THE POLICY

This policy shall be reviewed by the Board/Stakeholders Relationship & Customer Service Committee at annual intervals. Further, the policy shall also be amended whenever required due to changes in relevant regulatory guidelines or for any reason and the same shall be notified to the Board/ Stakeholders Relationship & Customer Service Committee promptly for their recommendation/approval.

The policy would be available on the company’s website and at all branches (on request). All employees of the company will be made aware of this policy.

Standard operating procedure (SOP) for Customer Grievance Redressal Mechanism / Escalation Process is marked as Annexure-A Annexure-A Standard Operating Procedure (SOP) of Customer Grievance Redressal Mechanism / Escalation Process

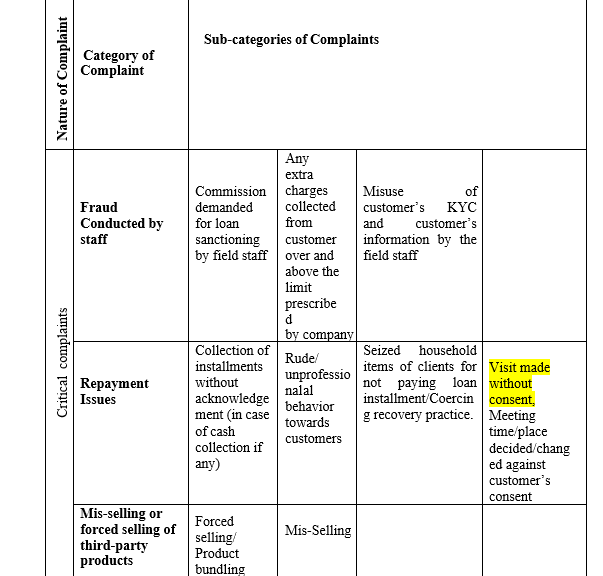

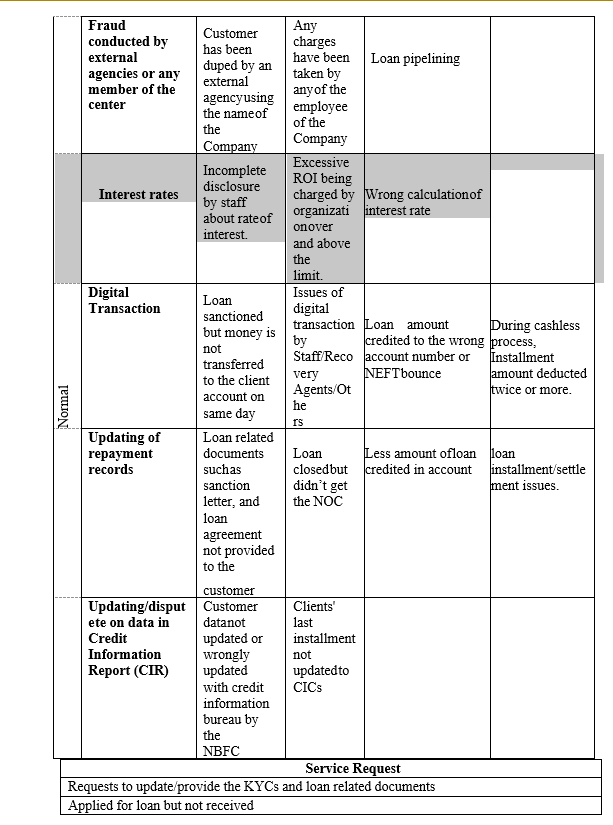

This document has been prepared in terms of the provision of Master Direction - Reserve Bank of India (Internal Ombudsman for Regulated Entities) Directions, 2023 which explains the standard operating procedure for Customer Grievance Redressal Mechanism and the escalation process for the grievances received by the organisation. Agarwal Assignments has designed robust mechanism where customers can register their complaints and get the resolution in the duration of 30 days. Below are the indicative list of complaints/services requests/queries that can be addressed through the available channels:

Reporting to the Committee & RBI

Internal Ombudsman will submit reports on cases referred to him/her and his/her analysis on the overall complaints received by the company to the Committee of the Board preferably on quarterly basis, but not less than half yearly intervals

i. Internal Ombudsman will also submit reports to the RBI as per the prescribed format in the intervals defined by the RBI.

ii. Internal Ombudsman will also submit reports to the RBI as per the prescribed format in the intervals defined by the RBI.

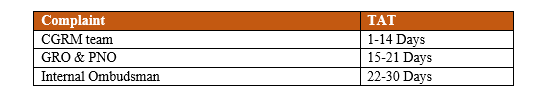

TAT (Turn Around Time for Resolution of Complaints)